KisanKonnect Raises ₹72 Cr Led by Bajaj Finserv, Scales Farm-to-Fork D2C Model in India

India’s D2C ecosystem is bustling this week — from agri-tech and wellness brands raising mega rounds, to fashion and food D2C players scaling rapidly, and inspiring founder journeys lighting the way.

1.KisanKonnect Raises ₹72 Cr Led by Bajaj Finserv, Scales Farm-to-Fork D2C Model in India

KisanKonnect, an Indian farm-to-fork startup, has secured ₹72 crore (around $8 million) in a pre-Series B funding round. Bajaj Finserv Group led the round, with participation from Mistry Ventures, Desai Foods, Dhanuka Agritech, and Action Tessa Family Office. This follows a $4.5 million Series A funding just months ago, which shows investors are confident in the company’s D2C model in India.

Vivek and Nidhi Nirmal founded KisanKonnect in 2020. The company is building a strong D2C food and beverage brand by sourcing directly from farmers and delivering to over 100,000 customers in Mumbai and Pune through its app and farm stores. KisanKonnect has set itself apart by being both a tech-driven logistics company and a consumer-focused D2C brand, tackling the tricky business of handling perishable goods in the Indian D2C market.

2. Libas Records 1 Lakh Festive Day-One Orders, Sales Jump 50% YoY in India’s D2C Ecosystem

Libas, an Indian fast-fashion brand, had a strong start to the festive season, exceeding 100,000 orders on day one. This marks a 50% increase from last year.

Sidhant Keshwani, Libas’ Founder and CEO, noted that over 60% of orders came from major online marketplaces, while the other 40% came directly through Libas’ website and app. This split suggests brands don’t need to lean only on marketplaces; they can create their own platforms to keep customers coming back. Libas has over 50 stores and a solid online presence, showing a good omnichannel plan.

Top-selling items included kurtas, kurta sets, co-ords, sarees, and loungewear. The brand processed over 50 orders each minute during the sales. Reduced taxes on clothing helped sales, making fashion more affordable.

This growth is good for Libas, especially since global investors are watching the Indian retail market. With funding becoming available, Libas’ growth makes it appealing to investors.

3.Kapiva Secures $60M Series D Funding, Fireside Ventures Exits as Ayurveda D2C Brand Scales Rapidly

Kapiva, a wellness brand focusing on Ayurveda, has secured $60 million in Series D funding, one of the year’s largest funding rounds for direct-to-consumer (D2C) brands. 360 ONE Asset and Vertex Growth led the round, with backing from existing investors Vertex Ventures Southeast Asia and India, and 3one4 Capital. Fireside Ventures, an early investor, exited during this round.

This investment underscores Kapiva’s position as a fast-growing D2C brand and shows increasing investor confidence in both Ayurveda-based D2C products and wellness-oriented D2C startups in India. $28 million of the total funds will go directly into the company as primary capital. The remaining amount facilitated a secondary transaction, allowing Fireside Ventures to sell its stake. The funding round began in September 2024 with a $10 million investment from OrbiMed Asia, Vertex Ventures, and 3one4 Capital. Ameve Sharma and Shrey Badhani started Kapiva in 2015. Overall, Kapiva has now raised close to $90 million, making it a top-funded D2C brand in India.

Business Boost

1. Hocco Scoops Up ₹115 Cr Series B, Valuation Surges to ₹2,000 Cr in Just Two Years

Ice-cream brand Hocco is making waves as a top D2C brand in India. They just raised ₹115 crore in Series B funding, led by Sauce VC, bringing their valuation to ₹2,000 crore. This funding round, the second part of their Series B, comes shortly after they raised $10 million (~₹85 crore) in the first part.

Since launching in 2022, Hocco has quickly become a popular D2C food and beverage brand, changing how people choose frozen desserts. They plan to use the new funds to grow their production, including a new plant in Sonipat and doubling capacity at their Gujarat plant. They’ll also be adding more freezers in various markets and increasing working capital to support growth. This shows they’re serious about expanding across India.

Ankit Chona, Hocco’s founder and MD, said the increase in valuation is due to the company’s high revenue growth. We initially aimed for ₹400 crore in revenue this year, but we’re now on track to exceed ₹500 crore in FY26. At our current rate, we expect to pass ₹700 crore in revenues next year, he noted.

2. Vama Secures ₹23.87 Cr in Pre-Series A Led by Wavemaker Partners, Expands Virtual Spiritual D2C Model in India

Vama, a virtual spiritual platform in Delhi, is about to secure ₹23.87 crore (about $2.7 million) in its pre-Series A round. Wavemaker Partners is leading the investment, with help from 500 Global, Venture Catalyst, 9Unicorns, Silver Needle Ventures, Sadev Capital, and some angel investors.

Manu Jain and Acharya Dev started Vama in 2020. According to regulatory filings, Vama’s board has given the go-ahead to issue 4,433 pre-Series A1 compulsory convertible preference shares at ₹53,466.8 each. Wavemaker Partners is putting in the most at ₹11.37 crore, followed by 500 Global at ₹4.37 crore and Silver Needle Ventures at ₹3.2 crore. Others involved are 9Unicorns (₹1.59 crore), Venture Catalyst, and angel investors like Alok Nanavaty, Harit Nagpal, Swati Parikh, and Mahesh Kamdar. Back in June 2025, Wavemaker already invested ₹2.57 crore in Vama, showing they’re consistently confident in Vama’s business approach.

Founders Funded

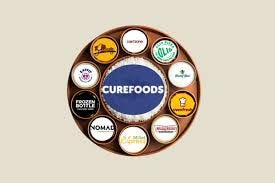

1. Binny Bansal-Backed Curefoods Raises ₹160 Crore in Pre-IPO Placement

Curefoods India, the multi-brand cloud kitchen operator, has secured ₹160 crore through a pre-IPO placement led by 3State Ventures, the investment arm co-founded by Flipkart’s Binny Bansal.

In this strategic move, Curefoods allotted 1.3 crore equity shares at ₹124 each to 3State Ventures, setting the stage before its planned public listing. The decision to route this capital through a pre-IPO round will be adjusted against the fresh issue size in the upcoming IPO in line with SEBI norms.

Earlier this year, Curefoods filed its draft red herring prospectus (DRHP) with SEBI, targeting a total capital raise of up to ₹800 crore. The offering is structured to include both a fresh issue and an offer for sale by existing backers including Iron Pillar, Chiratae Ventures, Accel, and Crimson Winter.

2.Bersache Becomes ₹130 Crore D2C Footwear Success Story Without External Funding

In a startup ecosystem where raising capital often takes the limelight, Bersache, a direct-to-consumer (D2C) footwear brand, has quietly built an empire. Co-founders Pankaj Garg and Shurbhi Garg have scaled Bersache to ₹130 crore in annual revenue — all without accepting a single rupee of external investment.

The brand was founded to address a previously unserved gap in the Indian footwear market: something stylish enough to capture global fashion appeal, yet affordable, durable, and tailored for Indian terrain. Bersache delivers on that promise through a combination of high design sensibility, fashion-forward styling, and rigorous engineering suited to Indian climate and walking patterns.

A key to its success has been the bootstrapped, capital‐efficient strategy the founders have adopted. Without external funding, Bersache has focused intensely on cost discipline, marketing organically, optimizing supply chain costs, and reinvesting profits back into the business. The avoidance of middlemen, use of local materials, and an “agile” fashion release model allow Bersache to keep prices low while maintaining margin and quality.

🧑💼 Founder’s Corner

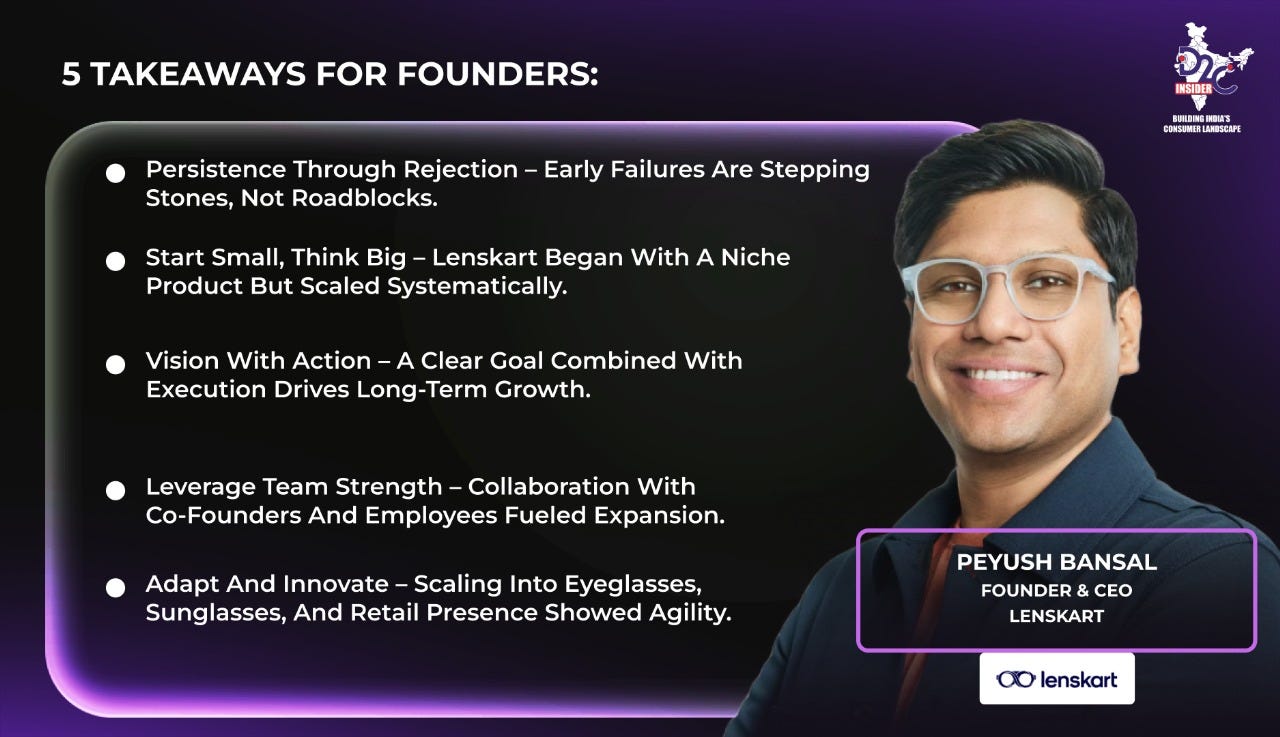

“From rejections to building a billion-dollar vision”

Peyush Bansal’s journey from a middle-class family in Delhi to founding Lenskart — India’s leading eyewear D2C brand — is a story of resilience, vision, and relentless execution.

After not cracking IIT, Peyush moved to Canada for higher studies and later joined Microsoft as a Program Manager in Redmond, Washington. But the corporate world couldn’t contain his entrepreneurial spirit. In 2007, he returned to India to chase bigger dreams.

He began with SearchMyCampus, a classified portal for students, before launching Lenskart in 2010 alongside Amit Chaudhary and Sumeet Kapahi — initially an online platform for contact lenses. Peyush’s vision didn’t stop there; Lenskart expanded into eyeglasses and sunglasses, eventually scaling into a retail powerhouse.

By 2019, Lenskart became a unicorn, valued at $1.5 billion, with 600+ retail stores and 4,000 employees serving millions. Peyush became a household name in 2021 after appearing as a Shark on Shark Tank India. His story is a testament to how setbacks are just steps on the path to success.

💡 “Your failures don’t define you — your determination and vision do. Keep building, keep learning, and stay relentless.” — Peyush Bansal

🚀 D2C Insider Weekly Update | CXO Meet – South 2025

South India is set to witness a landmark gathering in the consumer startup ecosystem this October. On 31st October 2025, Bangalore will welcome the CXO Meet – South, positioned as India’s flagship meet for D2C founders.

This event will serve as a vibrant platform for founders, investors, and ecosystem enablers to connect, exchange insights, and explore collaborations — driving the next chapter of India’s consumer revolution.

Here’s What to Expect:

150+ Founders leading India’s new-age consumer brands

100+ Innovative Brands redefining trends and shaping consumer behavior

25+ Investors & Enablers fueling high-potential ventures

The agenda features hands-on sessions covering topics like fundraising strategies, omnichannel growth, brand storytelling, and consumer insights — designed to help founders scale their brands effectively.

For anyone driving or supporting India’s D2C ecosystem, CXO Meet – South isn’t just an event; it’s a hub for networking, learning, and turning bold ideas into action.

📌 Event Details:

Date: 31st October 2025

Venue: Yutori Spaces, Safina Plaza, Infantry Road, Bangalore

Time: 2:00 PM – 8:00 PM

🔗 Register Here: https://d2ci.co/cxo-meet-register