D2C Weekly Buzz | Edition 120

✨ This week in India’s D2C revolution:

Honasa Enters Men’s Grooming with Reginald Men Acquisition, Strengthening Its D2C Growth Play

Crompton Bets Big on Tier II & III India, Targets ₹15,000 Cr Turnover with Omnichannel D2C Push

CaratLane Launches Shaya Diamonds, Entering the Silver Diamond Jewellery Segment

Rotoris Raises $3M Seed Round to Build a Global Premium D2C Watch Brand from India

SuperYou Raises $7 Mn Series B Led by V3 Ventures, Accelerates India’s Protein-First D2C Nutrition Play

Lucira Targets ₹100 Cr Revenue, Accelerates Offline Expansion to Build a Profitable Omnichannel D2C Jewellery Brand

👇 Scroll down for:

National Disruptors | Business Boost | Founders Funded | Founder’s Corner

National disrupters

Honasa Enters Men’s Grooming with Reginald Men Acquisition, Strengthening Its D2C Growth Play

Honasa Consumer Limited, known for brands like Mamaearth and The Derma Co, is moving into men’s personal care by buying Reginald Men. The deal, worth ₹195 crore and announced on December 11, marks Honasa’s first big step into the men’s grooming space. This supports their plan to shape the future of India’s direct-to-consumer market.

In what might be remembered as a key direct-to-consumer deal of 2025, Honasa will acquire 95% of BTM Ventures Pvt Ltd, which owns Reginald Men, through a secondary sale. After a year, they’ll buy the remaining 5% at a price agreed upon by both parties. This action fits with the trend of established Indian direct-to-consumer companies growing their business by buying other brands instead of developing everything themselves.

Reginald Men, started in August 2022 by Trisha Reddy Talasani, quickly became a popular premium direct-to-consumer personal care brand for men. In just over two years, the brand made over ₹70 crore in revenue between November 2024 and October 2025, with profit margins close to 25%. Their Helios Moisturizing Sunscreen has become the most searched sunscreen for men on Google in India, showing how a focused approach can drive fast direct-to-consumer revenue.

For Honasa, this purchase gives them quick entry to a growing consumer group. Men’s grooming and skincare is expanding fast within the Indian direct-to-consumer beauty market, driven by changing consumer habits and online trends. Reginald Men’s success in South India also strengthens Honasa’s reach, supporting their plans to grow beyond major cities.

Varun Alagh, Co-Founder and CEO of Honasa Consumer Limited, mentioned that Reginald Men’s grasp of the modern male consumer and their quick actions align with Honasa’s goals. This shows a move toward buying brands with good performance, strong profit margins, and clear leadership in their category, instead of just focusing on size.

River Mobility Marks 20,000 Indie Scooter Production Milestone, Accelerating Its D2C EV Growth Journey

River Mobility just hit a big milestone, delivering its 20,000th Indie electric scooter from its Hoskote plant in Karnataka. This comes just two years after the Indie launched and six months after hitting the 10,000-unit mark. This shows they’re ramping up production, demand is up, and their direct-to-consumer strategy in India is working.

Looking at D2C trends in India, River Mobility’s progress shows how a good product and careful growth can create momentum in capital-heavy areas like EVs. Unlike some startups, EV brands in India need to handle manufacturing, retail growth, and customer experience all at once. River doubling production in six months suggests growing trust in their brand and readiness to scale.

Aravind Mani and Vipin George started River Mobility in March 2021. They’ve carved out a place as a premium, city-focused electric scooter brand for daily commutes. The Indie scooter has gained popularity among city riders looking for durability, storage, and practicality. This has allowed River to expand from Bengaluru to Rajasthan, Madhya Pradesh, Delhi, and Maharashtra, strengthening its market presence.

As part of their D2C plans, River opened a store in Delhi and launched the Indie Gen 3, their latest scooter. These upgrades prove River focuses on D2C product releases based on real-world feedback, not just cosmetic changes. Right now, they have almost 40 stores across India, with a good footprint in cities like Bengaluru, Chennai, Hyderabad, Kochi, and Coimbatore. They plan to enter Punjab, Uttar Pradesh, and Gujarat, signaling an aggressive but measured omnichannel D2C approach.

Business boost

Crompton Bets Big on Tier II & III India, Targets ₹15,000 Cr Turnover with Omnichannel D2C Push

Crompton, with 85 years in the business, is now targeting Tier II and Tier III markets. It’s working to build a stronger, modern shopping experience for customers in India, both online and in stores.

Known for its reliable fans and pumps, Crompton is now a well-known brand for electrical and home appliances in India. It’s the world’s biggest ceiling fan company, a long-time leader in residential pumps, a top online seller of water heaters, and the biggest name in mixer grinders. The company holds about 10% of the market in these areas. Over time, Crompton has moved into water heaters, air coolers, kitchen appliances, and new areas like solar pumps and rooftop solutions, growing its potential market.

A major step for Crompton was buying Butterfly, which improved its kitchen appliance selection and boosted its mixer grinder sales. This fits with the trend of big companies using purchases to strengthen their hold on certain product categories and increase online sales. Today, Crompton wants to not just sell products, but provide solutions for daily household needs through good design, energy efficiency, and lasting value.

This change, called “Crompton 2.0” internally, means the company is focusing more on being relevant, quick, and understanding what consumers want. Crompton is paying attention to changing lifestyles, the desire for higher-end products, and the need for convenience. Research and development investments are driving new products, with a focus on premium and high-performing items.

Crompton’s plan to sell both online and in stores is key to its growth. It has a strong network of over 6,000 distributors and almost 300,000 stores in both cities and rural areas, providing a reach that many online-only businesses can’t match. At the same time, its online sales, including e-commerce platforms and its own website, have grown fast. While physical stores still bring in about 80–85% of revenue, Crompton’s online business has reached ₹1,000 crore and is growing by more than 20% each year.

CaratLane Launches Shaya Diamonds, Entering the Silver Diamond Jewellery Segment

CaratLane, the Tata Group-backed jewelry seller, is changing the Indian jewelry market with its new Shaya Diamonds line. This line features real diamonds in 925 silver.

This move expands the product range for a well-known Indian brand, showing how established yet modern companies are adjusting to new customer behaviors, price concerns, and preferences for jewelry that can be worn daily. Shaya Diamonds is a timely answer to high gold prices and shifting demands. By offering real diamonds at reasonable prices, CaratLane is making it easier for first-time buyers, younger shoppers, and those buying gifts to enter the market. These groups are increasingly boosting sales in the online jewelry business in India. Prices start at ₹5,000, making it an affordable way to own diamond jewelry without the high cost of gold.

Shaya Diamonds is designed to be a mix of fancy jewelry and everyday wear. CaratLane says this is the first time real diamonds have been widely offered in 925 silver settings in India. This approach combines stylish designs with practicality and value, which appeals to online shoppers in India who want versatile, frequently used, and personalized items rather than pieces for special occasions only.

Saumen Bhaumik, Managing Director at CaratLane, said that diamonds are still key to the brand. As gold prices increase, Shaya Diamonds gives customers a new way to buy real diamonds without spending too much. This fits with current market trends, where brands are coming up with new materials, styles, and prices to keep growing while maintaining value.

The launch also strengthens Shaya by CaratLane, the retailer’s brand that focuses on individuality and modern design. Ajith Singh R, Associate Vice President and Business Head at Shaya, said that using diamonds with silver brings a fresh, everyday feel to jewelry, making it appealing for more than just weddings or investments. This design-focused approach places Shaya Diamonds in the online fashion and lifestyle conversation.

Founders funded

Rotoris Raises $3M Seed Round to Build a Global Premium D2C Watch Brand from India

Rotoris, an analog watch brand driven by engineering, got $3 million in seed funding this December to create what it calls India’s first truly global watch brand. Backers include Nikhil Kamath, Vivek Anand Oberoi, Venture Catalysts, 100 Unicorns, Tanmay Bhat, and over 30 Indian founders.

Co-founded by Aakash Anand, who grew Bella Vita Organic into India’s biggest fragrance company, serial entrepreneur Prerna Gupta, Anant Narula, and Kunal Kapania, Rotoris is building a premium, direct-to-consumer India brand focused on modern watchmaking. They aim to blend design, mechanics, and global goals.

The money will go towards better manufacturing and assembly, upgrading engineering, a stronger supply chain, new inventory, and the first Rotoris Experience Store. The company will also invest in talent for product, design, and brand. This all supports their aim to grow as a global direct-to-consumer brand from India. These moves show a trend of premium direct-to-consumer brands in India expanding into omnichannel brand building.

Investor Vivek Anand Oberoi sees Rotoris as a mix of Indian ambition and global engineering, while Tanmay Bhat noted the brand’s emotional appeal and vision. Other backers include Varun Alagh (Mamaearth), Gaurav Khatri (Noise), Siddharth Dungarwal (Snitch), Vishesh Khurana (Shiprocket), and Arjun Vaidya (Dr. Vaidya’s), showing confidence in the brand.

SuperYou Raises $7 Mn Series B Led by V3 Ventures, Accelerates India’s Protein-First D2C Nutrition Play

SuperYou, a celebrity-backed D2C protein brand, has secured ₹63 crore ($7 million) in Series B funding. V3 Ventures led the round, with participation from existing investors Rainmatter and Gruhas Collective Consumer Fund. This funding marks a key step for the young brand and shows growing investor confidence in India’s quickly changing D2C wellness and nutrition market.

Launched in November 2024 under Think9 Consumer, SuperYou combines Direct-to-Consumer sales in India, functional nutrition, and modern snacking. The company was founded by Bollywood actor Ranveer Singh and entrepreneur Nikunj Biyani, nephew of Future Group founder Kishore Biyani. In less than a year, SuperYou has become one of the fastest-growing D2C startups in a very competitive market.

According to filings, SuperYou’s value after this funding is now between ₹600–660 crore ($66–73 million), showing good growth in sales and distribution. The brand is reportedly operating at an ARR of ₹150 crore and aims for ₹1,000 crore in annual sales within five years, with a long-term goal of 15% EBITDA margins. This makes SuperYou one of the most ambitious D2C brands in India’s nutrition market.

The new funding will support research and development, wider distribution, and team growth, as SuperYou focuses more on product innovation and expansion. With increased protein consumption and health awareness in India, the brand is creating a range of products that combine taste, convenience, and health benefits—an approach that fits with current D2C consumer behavior in India.

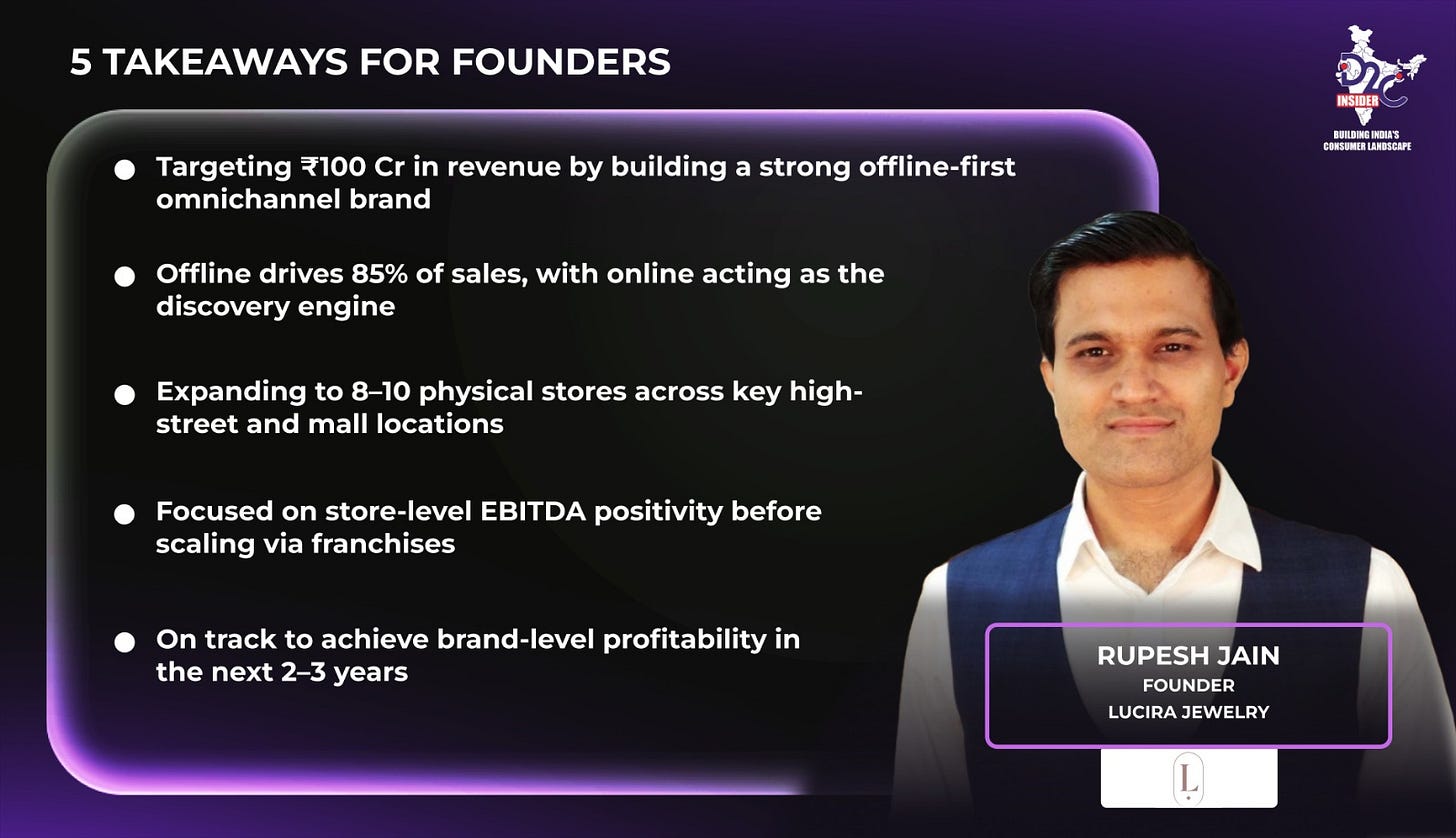

“Our strongest growth is coming from physical stores—we’ve opened two in Mumbai and Pune in just three months and are scaling to 8–10 stores across major cities by FY26”

Lucira, a brand specializing in lab-grown diamonds, is aiming for ₹100 crore in sales within three years. They’re increasing their focus on physical stores while building a strong online and offline brand.

Started as an online company eight months ago, Lucira is now investing heavily in brick-and-mortar stores, as this change reflects a trend where D2C (direct-to-consumer) brands in India prioritize building trust through in-person experiences.

According to co-founder Rupesh Jain, their strongest growth has come from their physical locations. In the past three months, they’ve opened two stores in Mumbai and Pune, with plans to open a third soon. By fiscal year 2026, Lucira wants to have 8–10 stores in major cities like Mumbai, Delhi, and Kolkata, choosing locations on main streets and in malls to attract more customers.

Each store will be about 800–1,000 sq. ft., costing around ₹60–70 lakh to set up. Lucira is currently running these stores themselves to maintain control and consistency. They aim for each store to be profitable within six to nine months. Their first store is already profitable, which reinforces their confidence in their offline retail strategy.

While Lucira started online, most of its sales now come from physical stores (85%), with the remaining 15% from online channels. They see their website as a tool for customers to research before making purchases in person. The average online order is ₹35,000–₹40,000, while in-store purchases average ₹65,000–₹70,000. This mix shows the strength of Lucira’s combined online and offline strategy.

Lucira offers about 1,500 lab-grown diamond products, including everyday and special-occasion jewelry. The brand focuses on design, sustainability, and affordability, which aligns with what Indian consumers want.

Lucira has received nearly ₹45 crore in funding from Bloom Ventures and Spring Marketing Capital. They’re using about 60% of this money to expand their distribution and retail presence, with the rest going towards hiring, operations, and store setup. The company is currently spending ₹50–60 lakh per month and expects to break even in the next two to three years.

As competition increases in the Indian D2C market, Lucira’s focus on carefully planned offline expansion, prioritising store profitability, and a solid online and offline approach should allow it to become a leading lab-grown diamond brand in India.

📌 D2C INSIDER WEEKLY UPDATE — IT’S TODAY 🚀

Today’s the day.

The D2C Insider Regional CXO Meet – West goes live in Mumbai.

Founders. Operators. Decision-makers.

One room. Real conversations. Real connections.

And once the discussions wrap up…

The D2C Mafia After Party takes over — an unforgettable night with the people building India’s consumer future.

Badges ready. Energy high.

Let’s make this one to remember.

Mumbai, see you today. 🔥✨